Motorcycle usage is much different than cars, so applying the same insurance plans doesn’t make sense for most people. In the US, most motorcycles are used for recreational purposes rather than daily transportation. So, the average monthly mileage is relatively low for many owners, and many bikes are parked or used less during the winter months, but you are forced to pay for coverage anyway. VOOM Insurance (in collaboration with Markel Insurance) introduced a pay-per-mile motorcycle insurance option in 2021 that significantly reduces the cost in many cases. We did some comparison shopping to see if we could save money on our own insurance and ran some example comparisons to see who may benefit from the VOOM Insurance pay-per-mile option.

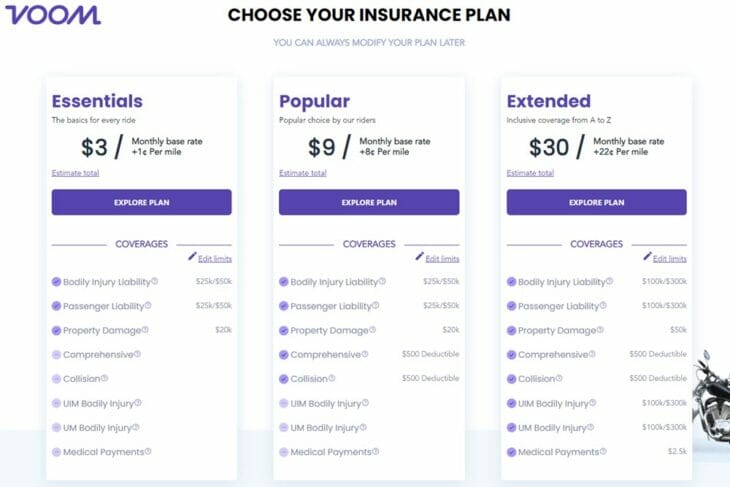

Rather than a flat annual fee, your VOOM Insurance rate is based on your actual monthly mileage along with a flat base rate between $3.00 per month for a basic package and up to $30 per month for the “extended” option. When you activate your VOOM Insurance policy, you take a picture of your odometer and easily upload it directly from your camera. Each month, you get a reminder to send in a new photo of your odometer to calculate your pay-per-mile cost. If you ride less, you pay less that month. And if you forget to send the photo, you will be charged a default mileage amount and that will be reconciled in future months based on your actual mileage. In our analysis, even the high mileage months resulted in a lower cost than a typical flat monthly rate from other insurance companies in many cases. So the total annual cost was less, but not in all cases.

As of this writing, VOOM is only available in Arizona, Oklahoma, Iowa, Missouri, Wisconsin, Illinois, Indiana, and Ohio (Texas and Tennessee were added soon after we completed this article), but they are working on adding more states. I live in Arizona and own four street-legal motorcycles, so I made some cost comparisons with VOOM and my current policies and analyzed other example riders/bikes in the other states VOOM is currently available. In most comparisons, especially those with lower monthly mileage, VOOM resulted in a lower rate. In some cases, especially for those that ride more miles, VOOM was more expensive, so it is best to make your own comparisons.

In my case, I recently purchased a KTM 300 two-stroke off-road motorcycle that is legal to register for the street in Arizona (when properly equipped with turn signals, horn, mirror, etc.). The VOOM Insurance cost for this bike was about 50% less than my current insurance provider, so I purchased the VOOM Insurance policy for that bike. Because I ride this bike relatively low mileage, the pay-per-mile option is great. I also own a 2021 Yamaha Tenere 700 ADV bike that I ride around 2400 miles per year, and in this case, the VOOM Insurance quote was about 30% more than my current provider. So this points out the need to make your own comparisons. The combined cost of the two bikes using the VOOM pay-per-mile option was about 5-10% less than my current provider based on my estimated monthly mileage. And because three of my four motorcycles are dual-sport bikes that I ride relatively low monthly miles with, VOOM Insurance is a good option for me.

This video does a great job of explaining how the VOOM pay-per-mile pricing works.

VOOM provided some additional cost comparisons for different bikes, riders, states, and mileage estimates. A 34-year-old with six years of riding experience insuring a 2010 Harley-Davidson FLHTC in Ohio resulted in a lower cost at all three of their Basic, Popular, and Extended options, even up to 3000 miles per year versus Progressive and Dairyland Insurance. On the flip side, a 38-year-old with four years of riding experience insuring a 2017 Kawasaki ZX-6R in Illinois resulted in a lower cost than Progressive and Dairyland with their Basic package and mileage below 1500 miles per year but higher cost when using the Popular or Extended packages. So again, it is recommended that you compare options and keep VOOM Insurance on that list of companies to consider.